In October 2023, data suggests that gold will still be one of the most actively traded commodities, now along with increased interest from both institutions and retail investors. With the current global conflicts combined with the constant change in interest rates, gold will still be preferred by many traders and investors as a safe haven investment. Neo traders will need reliable analysis and documentation to trade, and in this instance the best forex signals will come in quite handy. These signals assist traders on when to enter and exit a trade based on both technical and fundamental data.

The Changing Landscape of Gold Trading

The past few years have seen algorithmic trading and artificial intelligence fundamentally change how the market is participated in. Unlike the past decades where the price of gold was mostly dependent on the activities of central banks, these days' markets respond in real time to an inflation report, employment numbers, and even comments on monetary policies. Forex traders increasingly depend on the top forex signals to sift the noise in the markets and concentrate on tradeable moves. These signals shed light on the best price levels to trade and pinpoint the times when volatility is an opportunity to make money.

Why Signal Indicators Matter in 2025

Due to the shift in competitiveness from 2020 to 2025, traders who wish to remain in the game need to cut through the noise. Constantly moving delays understanding the value of actionable insights in real time in combination with complex fundamentals models. Hesitation is no longer an option, the slowing of geopolitics has closed any windows between the avalanche of conflicting news, elite traders prefer instant confidence. It is light years ahead of charting gold. Closing windows of indecision allows gold traders to conduct timely trades.

Technical Indicators Driving Gold Trades

Strategies based on technical analysis still dominate gold trading. A few of the most common are Moving Averages, RSI, and Bollinger Bands. The 50-day and 200-day moving averages, for example, are often termed as important markers for long-term critical trend shifts. RSI marks potentially overbought and oversold situations, while Bollinger Bands pinpoint volatility. Used individually, these indicators result in the best gold signals of lowest risk and maximum reward which ensure that trades are conducted on facts and not guesses.

Fundamental Triggers and Macroeconomic Factors

Apart from graphs, traders have to consider the state of the world economy. Gold prices react strongly to U.S. Federal Reserve announcements, inflation, and international tensions. Higher inflation expectations lead to a greater demand for gold as a way to protect one's purchasing power. Likewise, geopolitical tension tends to raise the price of gold as a safe-haven asset. Contemporary signal providers put the models together in a way that the signals correspond with regard to technical aspects to the economic and geopolitical factors of the model. This balance of economic knowledge with the best forex signals offers traders a more complete way to work with these signals.

Sentiment Analysis and Market Psychology

Sentiment analysis is a more prominent feature of gold trading. Traders conduct event-driven analysis based on news headlines, central bank speeches, and even public discussions on social media. They figure out how the market is positioned towards different events. Now, the more advanced platforms have begun using sentiment-driven tools to determine when investors act more aggressively than what market prices reflect. They act more aggressively even when the prices are low. Together with the top forex signals, sentiment analysis identifies periods of illogical market chaos. It improves the risk management and defensive position of the investors.

The Importance of Risk Management Tools

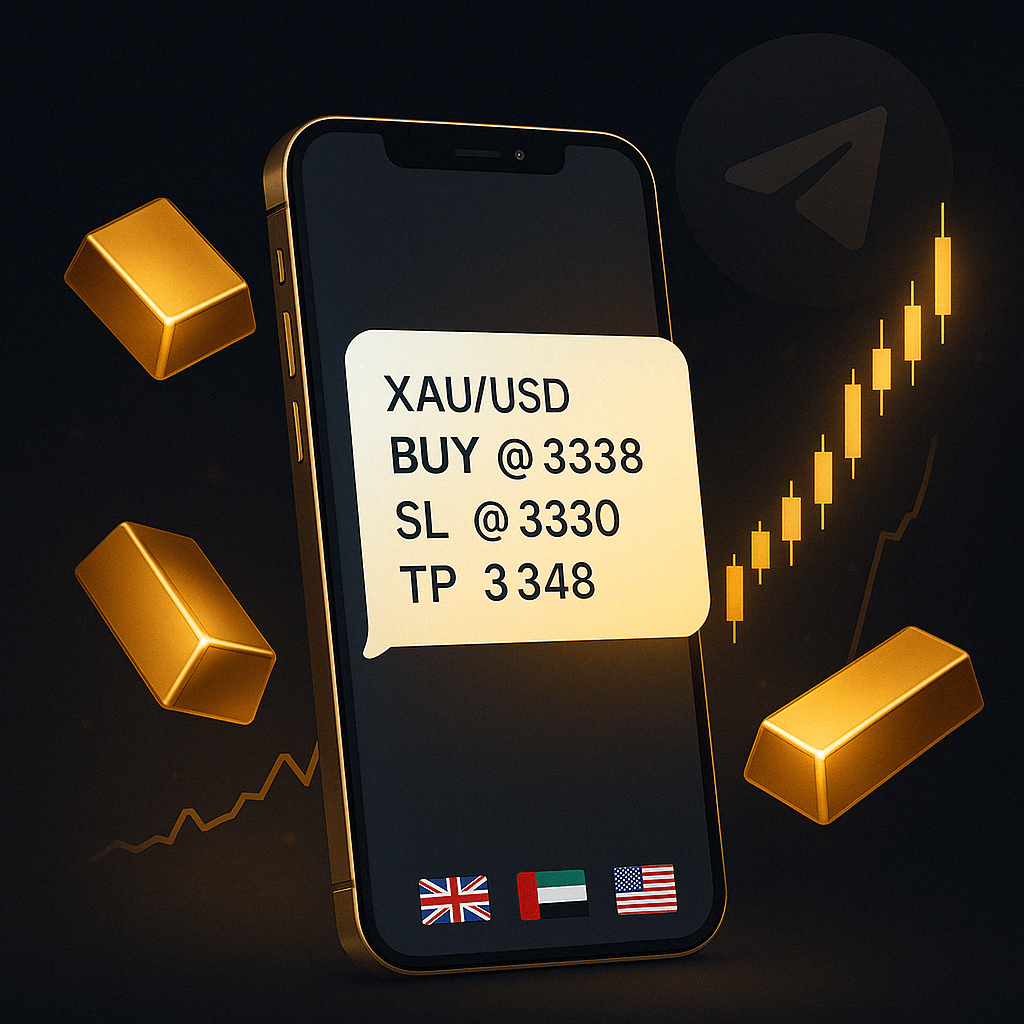

Every signal system has its flaws, and that is why risk management is needed. The range of position size and stop-loss levels must also be defined alongside risk-to-reward ratio parameters. Using advanced terminals, other professionals are able to automate headline and tail risk management when accurate gold signals are generated. For example, gold signals have defined parameters for buy entries near support levels, yet may trigger excessive drawdowns if no automated stop loss is in place to manage volatility. The system must be able to cover losses while the market is in a fixed state. risk management.

Artificial Intelligence in Signal Generation

As of 2025, artificial intelligence can be considered a breakthrough in technology. Machine learning systems evaluate thousands of data points every second and even find correlations that are undetectable to humans. These systems produce best gold signals and learn through historical data and change their strategies in real time. The traders enjoy heightened accuracy, cared for by the evolving algorithms to reflect real time market data. Gold signal algorithms are dynamic in nature, evolving real time and unlike traditional strategies lose relevance in changing markets.

Choosing the Right Signal Provider

There is more than one provider and more than one platform offering signaling and trading on those signals, so it is still important to pick any one provider. As a minimum, traders need to check the provider's track records, methodology, and customer support. Providers with full service, such as technical setups and notes of the economy with discernment updates, are more trustworthy. Closing off, beginners with resources to understand the signals also have more value, so it is important that all users know the reason behind every recommendation. The best forex signals require reputation and trading, which a trader will definitely receive many of with a proven strategy of guessed signals.

The Future of Gold Trading Strategies

In tandem with evolving technology, the signals catering to gold trading are likely to become more sophisticated. While traders interacted with the market only through cloud-based platforms, the use of blockchain technology for foolproof signals along with AI-powered predictive analytics is bound to change the trading signal paradigm. There is a strong emphasis on technical indicators; however, there is a growing relevance for indicators that are interdisciplinary and driven by data, and there is bound to get more such indicators. Traders and strategists who accommodate change, along with a heavy dependence on top forex signals relative to their trading plans, will be extremely successful in the foreseeable future.

Conclusion

Gold trading in 2025 demands more than intuition or guesswork. It requires systematic approaches built on trustworthy indicators, adaptive technology, and disciplined execution. Reliable signal systems are no longer optional—they are essential tools for navigating volatile markets and capitalizing on opportunities at the right moment. Traders who succeed will be those who embrace innovation while applying sound judgment in every trade, and this approach is strongly reflected in the expertise of United Kings, a leading force that continues to set high standards in the industry.