Ever copied a signal perfectly… and still ended up with a worse result than everyone else?

That’s usually not because the signal was “bad.” It’s because forex signal execution is a skill on its own—one that separates consistent traders from frustrated subscribers.

In this guide, we’ll break down exactly how to trade signals like a professional: how to time entries, size positions, manage multiple take-profits, use trailing stops, and avoid the execution mistakes that quietly drain accounts.

TL;DR — Professional Forex Signal Execution in 60 Seconds

- Execution beats intention: the same signal can produce very different results depending on entry type, spread, and timing.

- Use a sizing rule, not emotions: risk a fixed % per trade (often 0.5%–2%), calculated from stop distance in pips.

- Plan your entry method: market entries for momentum, limit entries for pullbacks, stop entries for breakouts—don’t guess.

- Manage multi-TPs like a system: partials reduce variance, but only if your stop strategy is consistent (e.g., move to breakeven after TP1).

- Trailing stops are tools, not magic: trail after structure forms (higher lows / lower highs), not randomly after a few pips.

- Avoid the “execution killers”: late entries, widening spreads, revenge re-entries, and ignoring session timing (London/NY matter).

For reference, current market context we’ll use in examples: Gold (XAUUSD) around $2650, EUR/USD 1.0520, GBP/USD 1.2680, USD/JPY 149.50, and DXY 106.80. Volatility is healthy, so execution discipline matters more than ever.

What “Signal Execution” Really Means (And Why Pros Treat It Like a Strategy)

Most traders think a signal is the strategy. Professionals know the signal is only the idea.

The real edge comes from how you turn that idea into a live position: what order type you use, how you handle slippage, whether you enter during liquid hours, and how you manage the trade once price moves.

Here’s the uncomfortable truth: two traders can receive the same EUR/USD buy at 1.0520 with SL 1.0480 and TP 1.0600, and one will bank +80 pips while the other gets stopped. Not because the market “hated” them—because their execution changed the trade’s math.

Forex signal execution includes:

- Entry timing: entering immediately vs waiting for spread normalization vs entering on a retest.

- Order selection: market, limit, stop, stop-limit, and how each behaves in fast markets.

- Position sizing: lot size derived from risk and stop distance, not from “what feels right.”

- Trade management: partial take-profits, stop adjustments, trailing logic, and exit decisions.

- Operational discipline: tracking performance, avoiding overtrading, and executing the same way every time.

If you’re using premium signals, execution is the bridge between “good analysis” and “real results.” That’s why at United Kings we focus heavily on how to execute, not just what to buy or sell, especially during the London and New York sessions when liquidity and follow-through are strongest.

If you’re still evaluating providers, you can also cross-check your process with our educational resources on the United Kings blog and our beginner-friendly guide to Forex signals on Telegram.

Before You Place Any Trade: The Pro Pre-Execution Checklist

Professionals don’t “wing it” when a signal drops. They run a short checklist that prevents 80% of execution errors.

Here’s a practical pre-execution routine you can complete in under 60 seconds.

Step 1: Confirm the instrument and quote format

Sounds basic, but it’s common to confuse XAUUSD vs XAUEUR, or place EUR/USD on the wrong account type (micro vs standard). Confirm the symbol and decimals.

Example: EUR/USD at 1.0520 has a 1-pip move of 0.0001. USD/JPY at 149.50 typically has a 1-pip move of 0.01. That affects your stop distance and lot size.

Step 2: Check spread and session liquidity

Spreads expand around rollovers, news, and low-liquidity windows. If EUR/USD spread is normally 0.8–1.5 pips on your broker but jumps to 3–5 pips, your entry quality changes.

As a rule, execution is usually cleaner during London and New York. That’s one reason United Kings focuses heavily on those sessions.

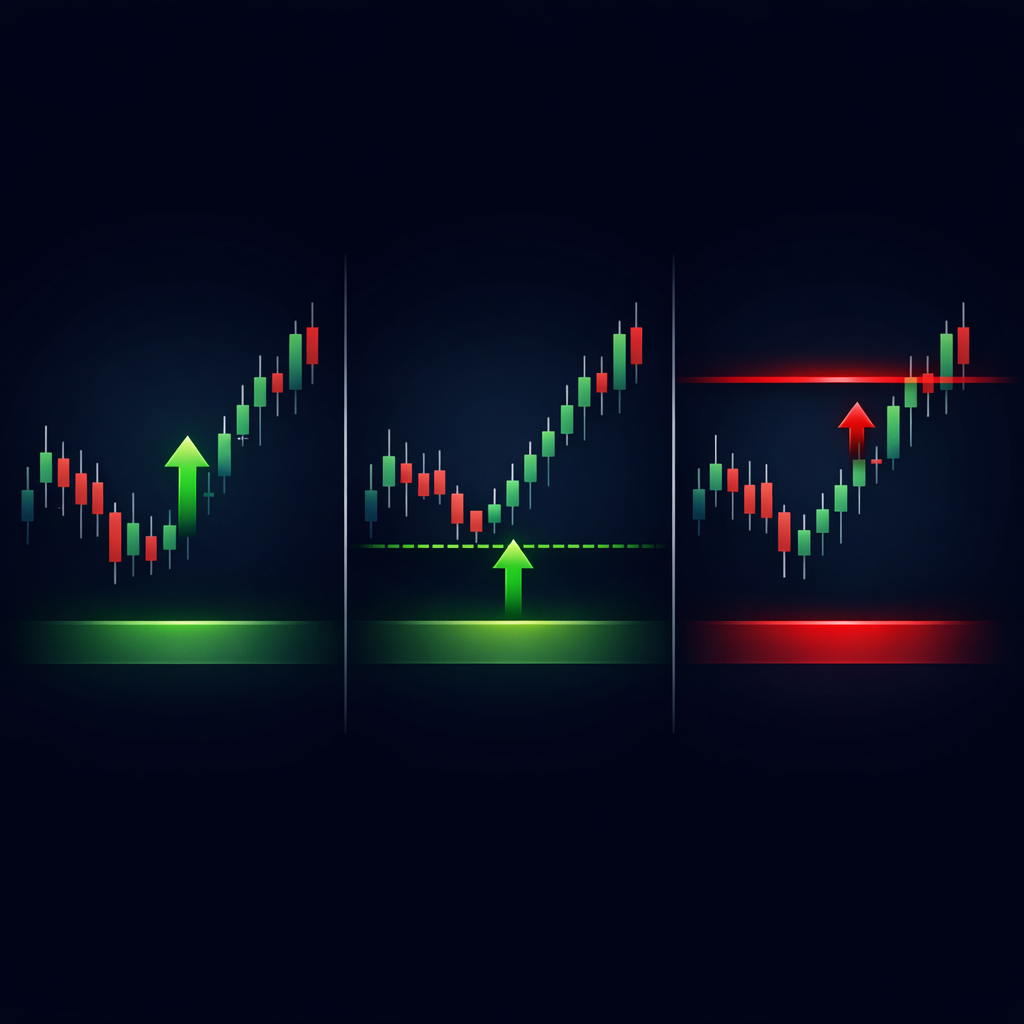

Step 3: Identify the signal type: momentum, breakout, or pullback

Execution depends on intent:

- Momentum: you want immediate participation, so market entry or tight stop orders make sense.

- Breakout: you need confirmation, so stop orders above/below a level are common.

- Pullback: you want a better price, so limit orders at a zone are often best.

If you treat every signal like a market order, you’ll overpay in pullback setups and get chopped in fake breakouts.

Step 4: Calculate risk and lot size before you enter

Pros don’t enter and then “figure out the lot size.” They compute it first, because lot size is your risk control.

We’ll cover exact sizing formulas later, but the key habit is: risk is decided before entry.

Step 5: Decide your management plan (multi-TPs, BE rules, trailing)

If the signal has TP1/TP2/TP3, you need a consistent plan for partial closes and stop movement. If you improvise, you’ll either cut winners too early or hold losers too long.

This is where many traders sabotage good signals. They win small and lose big—not because the signals are wrong, but because management is inconsistent.

Order Types for Forex Signal Execution (Market vs Limit vs Stop) + When to Use Each

Knowing how to trade signals starts with order types. Your order type is not a technical detail—it’s a strategic choice.

| Order Type | Best For | Main Advantage | Main Risk | Pro Tip |

|---|---|---|---|---|

| Market Order | Momentum entries, fast continuation moves | Guaranteed fill (most of the time) | Slippage & spread cost in volatility | Use during liquid sessions; avoid right before high-impact news |

| Limit Order | Pullbacks, retests, mean-reversion entries | Better price, reduced spread impact | Missed trades if price never retests | Place at structure (previous support/resistance), not “randomly cheaper” |

| Stop Order | Breakouts, confirmation entries | Filters some fake moves | Slippage on spikes; breakout traps | Set at least a few pips beyond the level to avoid spread sweeps |

| Stop-Limit | Controlled breakout entries | Caps your worst fill price | No fill if price jumps past your limit | Use in news-prone markets when you prefer missing a trade over bad slippage |

Let’s make this real with a scenario.

Imagine EUR/USD is at 1.0520 and a buy signal is issued with SL 1.0480 and TP 1.0600. If price is accelerating upward in London open, a market order might be appropriate because waiting could mean missing the move.

But if EUR/USD already spiked 25–35 pips and is now pulling back, a limit order (for example 1.0510–1.0505) might align better with the setup’s logic. You’re not being “cheap.” You’re matching execution to structure.

For USD/JPY around 149.50, stop entries matter because yen pairs can spike quickly on rate headlines. If the plan is to buy a breakout above 149.80, a stop order at 149.85 can reduce false triggers from spread flickers near the round number.

The professional mindset is simple: your order type should reflect what you need the market to prove. If you need confirmation, don’t use a limit. If you need a discount, don’t chase with a market order.

Entry Timing: How Pros Avoid Late Entries, Slippage, and Spread Traps

Most execution problems aren’t about analysis—they’re about timing. Traders enter too late, enter during spread expansion, or enter right into a liquidity vacuum.

Let’s break down the most common timing traps and how professionals handle them.

Late entry: the silent account killer

Late entry is when you enter after the market already moved significantly from the signal’s intended price.

Example: GBP/USD is around 1.2680. A buy signal comes at 1.2682 with SL 1.2642 (40 pips) and TP 1.2762 (80 pips). If you enter at 1.2702 because you were busy, you just added 20 pips of “cost.”

Now your real stop is effectively 60 pips, and your real reward is 60 pips. You turned a 1:2 setup into 1:1 without realizing it.

Pro rule: define an “acceptable entry window.” For majors, many disciplined traders use something like 3–8 pips max slippage from the intended entry (depending on volatility). For USD/JPY it may be 5–10 pips. If you’re outside the window, you either wait for a pullback or skip.

Spread traps: why the same entry prints different prices

Spreads aren’t fixed. They widen during rollovers, around news, and during thin liquidity.

If you trade at 23:58–00:10 broker time, you may see spreads widen dramatically. That can trigger stops or fill you poorly, especially on GBP pairs and gold.

On XAUUSD around $2650, a normal spread might be $0.20–$0.60 depending on broker. In volatile moments it can jump to $1.50–$3.00. If your stop is only $10 away, that matters.

Session timing: London and New York are not optional details

Liquidity creates cleaner technical behavior. That’s why many of the best moves in EUR/USD and GBP/USD occur during London open (roughly 07:00–10:00 London) and the London–NY overlap.

Professional execution means you consider the session:

- London open: strong directional moves, breakouts, and stop hunts are common.

- NY open: continuation or reversal depending on data and positioning.

- Asia: often range-bound for EUR/USD and GBP/USD, but USD/JPY can still move.

If you’re entering a breakout signal in Asia on EUR/USD, you should expect more fakeouts than in London. The signal may still be valid, but execution has to adapt—smaller size, wider confirmation, or waiting for liquidity.

Practical step-by-step: timing your entry like a pro

- Step 1: Check if we’re within 30 minutes of high-impact news. If yes, reduce size or wait.

- Step 2: Check spread vs your normal spread. If spread is 2–3x normal, pause.

- Step 3: Check how far price is from the signal entry. If outside your window, don’t chase.

- Step 4: Use the correct order type (market for momentum, limit for pullback, stop for breakout).

This is how professionals keep execution consistent—even when markets are moving fast.

Position Sizing for Signal Traders: The Exact Math Pros Use

If you want to execute forex trading signals like a professional, you need professional risk math. Not guesses. Not “0.10 lots feels safe.” Actual calculation.

Position sizing is the difference between a temporary drawdown and a blown account. It’s also the reason two traders can follow the same signals and get completely different equity curves.

The core rule: risk a fixed percentage per trade

Many disciplined signal traders risk 0.5% to 2% per trade depending on experience and drawdown tolerance. Beginners should lean smaller until execution is consistent.

Let’s say your account is $5,000 and you risk 1% per trade. That’s $50 maximum loss if the stop is hit.

Forex lot size formula (simple version)

Lot Size = (Account Risk $) / (Stop Loss in pips × Pip Value per lot)

For EUR/USD, pip value for 1.00 standard lot is roughly $10 per pip (varies slightly by broker/account currency). For 0.10 lot it’s ~$1 per pip.

Example (EUR/USD):

- Entry: 1.0520

- Stop: 1.0480 (40 pips)

- Account: $5,000

- Risk: 1% = $50

Lot size ≈ $50 / (40 pips × $10 per pip) = $50 / $400 = 0.125 lots.

So you’d trade ~0.12 lots (or 0.13 depending on rounding rules). That’s professional execution: the stop defines the size.

USD/JPY sizing: mind the pip value

On USD/JPY around 149.50, pip value per lot is not always exactly $10. Many platforms calculate it automatically, but you should still understand the mechanics.

If your stop is 50 pips (e.g., entry 149.50, SL 149.00), and you risk $50, your lot size will likely be close to 0.10 lots—but confirm with your broker’s calculator.

Gold (XAUUSD) sizing: use dollars per move, not “pips”

Gold execution is where signal traders often mis-size. XAUUSD moves fast, and contract specs vary by broker.

Let’s use realistic levels around current price $2650.

- Buy XAUUSD at $2650

- Stop at $2635 (risk = $15)

- TP at $2680 (reward = $30, a clean 1:2)

If your broker’s gold contract is such that 1.00 lot equals $1 per $0.01 move (common, but not universal), the P/L per $1 move can be significant. This is exactly why pros always verify contract size and use a position size calculator.

Professional habit: before copying a gold signal, confirm what 1 lot means on your platform. Then size so the dollar loss at SL equals your risk budget.

Two sizing mistakes that destroy signal performance

- Using the same lot size for every trade: a 20-pip stop and a 60-pip stop should not have the same lot size if your risk is fixed.

- Increasing lot size after a loss: that’s emotional sizing, not professional execution. It amplifies variance exactly when you’re already off-balance.

If you want a deeper dive on this topic, pair this article with our dedicated guide on risk management strategies when using forex signals.

Managing Multiple Take-Profits (TP1/TP2/TP3) Without Sabotaging the Trade

Multi-TP signals are powerful because they reduce emotional pressure. You lock something in at TP1, let the rest run, and smooth your equity curve.

But many traders execute multi-TPs in a way that quietly ruins expectancy. They take too much off too early, move stops too aggressively, or close the rest at the first pullback.

Why multi-TPs exist (the professional logic)

Markets rarely move in a straight line. EUR/USD might rally 40 pips, pull back 15 pips, then continue another 60. Multi-TPs allow you to monetize that path.

Professionals think in distributions: some trades will only hit TP1 and reverse, some will hit TP2, and a smaller portion will hit TP3. Your job is to structure exits so the winners pay for the losers.

A clean multi-TP template you can copy

Here’s a simple, professional framework that works for many signal styles:

- TP1: close 30–50% of the position at 1R (risk unit)

- After TP1: move stop to breakeven (or to -0.25R to cover costs/spread)

- TP2: close another 30–40% at 2R

- TP3: let the remaining 10–30% run with a trailing stop behind structure

Let’s apply it to gold around current levels.

XAUUSD example:

- Entry: $2650

- SL: $2635 (risk = $15)

- TP1: $2665 (1R = $15)

- TP2: $2680 (2R = $30)

- TP3: $2690 (2.67R = $40)

If you close 40% at TP1, you reduce psychological pressure. If price reverses after TP1, you likely exit the rest at breakeven instead of taking a full loss.

But here’s the key: don’t move to breakeven too early if the market hasn’t earned it. If your TP1 is at $2665 and price only reached $2657, moving SL to entry is just asking to get stopped by noise.

Execution detail: how to place multi-TPs correctly

- Option A (preferred): Split the trade into 2–3 smaller positions, each with its own TP.

- Option B: Use partial close features in MT4/MT5, then manually adjust SL.

Splitting positions is often cleaner because your platform handles the exits automatically. It also prevents “I forgot to close at TP1” errors.

The most common multi-TP mistake

Traders close 80–90% at TP1 because they want to “secure profit.” That feels safe, but it can destroy the strategy’s edge if the system relies on bigger runners.

Professional execution means you follow a consistent distribution. If your plan is 40/40/20, stick to it for at least 30–50 trades before judging results.

Trailing Stops Done Right: How Pros Lock Profit Without Getting Wicked Out

Trailing stops are one of the most misunderstood tools in signal trading. Used correctly, they can turn good trades into great ones. Used poorly, they turn winners into break-evens and create frustration.

The goal isn’t to trail “because price is green.” The goal is to trail when the market has formed new structure that supports your trade.

Three trailing stop styles professionals use

- Structure-based trailing: move SL below higher lows (in buys) or above lower highs (in sells).

- ATR-based trailing: trail by a multiple of ATR (Average True Range), e.g., 1.5× ATR.

- Step trailing: move SL only after specific milestones (TP1 hit, then TP2 hit, etc.).

Structure-based trailing is the most “price action professional” approach. ATR-based trailing is more systematic and adapts to volatility. Step trailing is simplest for signal followers.

Gold trailing example around $2650

Let’s say you buy XAUUSD at $2650 with SL $2635.

Price pushes to $2665 (TP1), then pulls back to $2658, then rallies to $2680 (TP2). A professional trailing approach might be:

- After TP1: SL to $2650 (breakeven) or $2652 (to cover costs).

- After a higher low forms at $2658: SL to $2657 (just below structure).

- After TP2 at $2680: trail SL to $2668–$2670 depending on structure/ATR.

Notice what we did: we didn’t trail $2 behind price randomly. We waited for the market to prove a higher low, then protected under it.

Forex trailing example on GBP/USD

Assume GBP/USD buy from 1.2680 with SL 1.2640 (40 pips). If price reaches 1.2720, pulls back to 1.2705, then continues, a structure trail might move SL from 1.2640 up to 1.2700 after the higher low is clear.

This keeps you in the trade through normal pullbacks, while still protecting profit if the market reverses.

The #1 trailing stop mistake

Trailing too tight because you’re afraid of giving back profit.

Markets breathe. EUR/USD can pull back 10–20 pips even in a strong trend. Gold can pull back $5–$12 inside a trend day. If your trailing stop doesn’t respect normal volatility, you’ll get stopped out constantly.

Professional execution means you trail based on volatility and structure, not on fear.

Execution in Volatile Markets: News, Spikes, and “Do I Still Take the Signal?”

When volatility rises, execution becomes the edge. With DXY around 106.80 and gold near $2650, it doesn’t take much—one CPI surprise, one central bank headline—to create a 60–120 pip swing in FX or a $20–$35 burst in gold.

The question isn’t “should I trade news?” The question is “how do I execute signals when conditions are fast?”

Know the three volatility regimes

- Normal: spreads stable, price respects levels, fills are clean.

- Elevated: ranges expand, pullbacks deepen, slippage increases slightly.

- Event-driven: spikes, spread blowouts, slippage, stop sweeps, and fast reversals.

In elevated and event-driven regimes, you need different execution rules.

Professional adjustments during high-impact news

- Widen your “acceptable entry window”: but only if your stop and sizing adjust accordingly.

- Reduce risk per trade: many pros cut risk by 25–50% around major events.

- Prefer limit entries after the spike: let the first impulse move print, then enter on the retest.

- Avoid moving stops too early: news candles often retrace sharply before continuing.

For gold, this is critical. A $15 stop (typical) can be hit in seconds during a headline spike. If you’re trading XAUUSD signals, you must respect the event calendar and your broker’s execution quality.

If you want a deeper understanding of how signals behave in shock moves, read how gold signals react to unexpected news events.

“Do I still take the signal if price already moved?”

Professionals answer this with a rule, not a feeling.

- If price is within the acceptable entry window: execute as planned.

- If price moved beyond the window: wait for a pullback entry or skip.

- If the move happened due to news: treat it as a different setup and require new confirmation.

This prevents the classic mistake: chasing a candle, getting filled at the top, and then blaming the signal provider.

Common Forex Signal Execution Mistakes (That Even Smart Traders Make)

Execution mistakes are usually boring. They don’t feel dramatic in the moment. But over 50 trades, they’re the difference between profitability and churn.

Here are the most common ones we’ve seen over years of working with signal traders.

Mistake 1: Moving the stop loss “to be safe”

You enter EUR/USD at 1.0520, SL 1.0480. Price dips to 1.0508 and you panic, moving SL to 1.0500. Then the market dips to 1.0498, stops you out, and rallies to 1.0600.

You didn’t manage risk—you changed the trade’s logic mid-flight.

Fix: If you don’t trust the original SL, reduce lot size. Don’t tighten stops randomly.

Mistake 2: Not accounting for spread on stop placement

On GBP/USD, spread can widen briefly even in liquid hours. If your stop is placed exactly at a known liquidity level, you can get clipped.

Fix: Place stops beyond structure, not exactly on it. Give the market room to breathe.

Mistake 3: Overlapping trades and accidental overexposure

You take EUR/USD long, then also take GBP/USD long, then take gold long—all while DXY is moving. You think you’re diversified, but you’re basically in one macro bet: USD weakness.

Fix: Track correlated exposure. If you’re in multiple USD-short positions, reduce per-trade risk or choose the best setup only.

Mistake 4: Re-entering after a stop-out without a rule

This is revenge trading disguised as “giving it another try.” If a signal stops out, re-entry should be based on a clear condition (e.g., reclaiming a level, new structure, session shift).

Fix: Limit re-entries. For many traders, max 1 re-entry per idea is enough.

Mistake 5: Treating every signal like a day trade

Some signals are designed to run. If you close early because you “don’t like holding,” you may destroy the edge.

Fix: Align your management with the signal’s intended horizon. If you prefer quicker trades, focus on sessions and setups that match your lifestyle.

Step-by-Step: A Professional Signal Execution Workflow You Can Copy

You don’t need more indicators. You need a repeatable workflow that you follow whether you feel confident or nervous.

Here’s a professional execution system you can copy exactly. It works for forex and gold and is especially effective in fast sessions.

Step 1: Read the signal like a trader, not a follower

- What is the direction and entry?

- Where is the stop and why?

- Where are the take-profits and what’s the risk-reward?

- Is it a breakout, pullback, or momentum continuation?

This takes 10 seconds, but it changes everything. You stop being reactive and start being intentional.

Step 2: Check execution conditions

- Spread normal?

- Any high-impact news within 30 minutes?

- Are we in London/NY liquidity?

If conditions are poor, you either reduce risk or wait. Professionals don’t force trades in bad microstructure.

Step 3: Calculate position size

Decide risk (e.g., 1% of account). Calculate lot size from stop distance. Round down if needed. This is non-negotiable.

Step 4: Place the correct order type

- Market if the setup requires immediate participation.

- Limit if the setup expects a pullback.

- Stop if the setup needs breakout confirmation.

If you’re not sure, don’t guess. Wait for price to show which style fits.

Step 5: Pre-place SL and TPs (don’t “add later”)

Professionals place SL and TPs immediately. “I’ll add the stop in a second” is how accounts get wrecked in fast moves.

Step 6: Manage with rules, not feelings

- If TP1 hits: partial close + stop adjustment per plan.

- If price stalls before TP1: do nothing unless your plan says otherwise.

- If volatility spikes: avoid impulsive stop moves; let structure form.

Step 7: Log the trade

Record entry, exit, screenshot, and whether you followed the plan. Over 30 trades, this becomes your personal execution improvement engine.

If you want to improve provider selection and execution fit, you can also use our forex trading signals provider checklist to benchmark quality and clarity.

Realistic Execution Examples (EUR/USD, GBP/USD, USD/JPY, XAUUSD)

Let’s put everything together with realistic, current-level examples. These are not “guaranteed outcomes.” They’re execution walkthroughs so you can see the decisions professionals make.

Example 1: EUR/USD momentum buy execution

Market: EUR/USD around 1.0520.

- Entry: 1.0520 (market)

- SL: 1.0480 (40 pips)

- TP1: 1.0560 (40 pips, 1R)

- TP2: 1.0600 (80 pips, 2R)

Execution plan: If spread is normal and we’re in London/NY, execute market. Split position into two parts. After TP1, move SL to breakeven on the remainder.

Common mistake: entering at 1.0535 after the move, turning the trade into poor R:R. Professional fix: wait for a pullback or skip.

Example 2: GBP/USD pullback execution with a limit

Market: GBP/USD around 1.2680.

- Idea: buy pullback into support

- Limit entry: 1.2670

- SL: 1.2635 (35 pips)

- TP: 1.2740 (70 pips, 1:2)

Execution plan: Place limit order and walk away. If it doesn’t fill, don’t chase. If it fills and hits TP1 equivalent, consider moving SL to breakeven only after a higher low forms.

Example 3: USD/JPY breakout execution with a stop order

Market: USD/JPY around 149.50.

- Buy stop: 149.85 (breakout confirmation)

- SL: 149.55 (30 pips)

- TP1: 150.15 (30 pips, 1R)

- TP2: 150.45 (60 pips, 2R)

Execution plan: Use stop order to confirm the break. Be aware of slippage risk. If the candle spikes through 149.85 during news, consider stop-limit or wait for a retest instead.

Example 4: Gold (XAUUSD) multi-TP execution near $2650

Market: XAUUSD around $2650 (+0.35% on the day).

- Buy: $2650

- SL: $2638 (risk = $12)

- TP1: $2662 (1R)

- TP2: $2674 (2R)

- TP3: $2686 (3R-ish)

Execution plan: Split into 3 positions. After TP1, move SL on remaining to breakeven only if spread is stable. After TP2, trail under the most recent higher low (often $6–$12 behind in active conditions).

If you actively trade gold signals, you’ll also want to explore our dedicated gold signals page to understand how we structure entries, stops, and targets for XAUUSD.

Tools, Platform Settings, and Telegram Habits That Improve Execution

Professional execution isn’t only about analysis. It’s also operational: platform setup, alerts, and how you consume signals.

Platform essentials (MT4/MT5/cTrader)

- One-click trading: reduces hesitation and late entries (use carefully with pre-set lot sizes).

- Default SL/TP templates: helps you avoid “no stop” mistakes.

- Trade panel calculators: use built-in pip value/lot size tools or a trusted calculator.

- Chart templates per instrument: gold vs majors behave differently; keep it clean.

A simple setup beats a complicated one. The goal is fewer clicks and fewer errors.

Telegram execution habits that pros use

- Turn on notifications only for the signal channel: reduce noise and impulsive trades.

- Pin the execution checklist: keep your rules visible.

- Use a second device if possible: one for Telegram, one for execution, to reduce mistakes.

If you want a clean starting point, our United Kings signals hub explains what you receive (clear entry, SL, TP levels) and how to follow along.

Broker and account type matter more than most people admit

Two traders with different brokers can experience different spreads, slippage, and stop execution. This is especially noticeable on gold and during news.

Professional approach:

- Prefer brokers with consistent spreads and solid execution history.

- Test execution on a demo before committing real size.

- Keep leverage reasonable so you don’t oversize by accident.

Signals are only as good as the environment you execute them in.

FAQ: Forex Signal Execution Questions Traders Ask Most

1) Should I always enter signals immediately?

No. Enter immediately only when the setup requires momentum participation and price is within your acceptable entry window. If price already ran, wait for a pullback or skip.

2) What risk % should I use when copying forex trading signals?

Many disciplined traders use 0.5%–2% per trade. If you’re newer or still making execution mistakes, start at 0.25%–0.5% until your process is consistent.

3) Is it better to use one position with multiple TPs or split into several trades?

Splitting into 2–3 positions is usually cleaner. Each position can have its own TP, and you reduce the chance of forgetting partial closes.

4) When should I move my stop loss to breakeven?

Common professional rule: move to breakeven after TP1 hits or after a clear structural shift (like a higher low). Moving to breakeven too early is a frequent reason traders get wicked out.

5) Can I follow forex signals if I have a full-time job?

Yes, but you need an execution plan that matches your schedule. Use pending orders, pre-set SL/TP, and focus on London/NY windows you can reliably monitor. Demo-test your workflow first.

Risk Disclaimer (Read This Before You Trade)

Forex and gold trading involves significant risk and may not be suitable for all investors. Signals and examples are for educational purposes and do not guarantee profits. Past performance does not guarantee future results. You can lose some or all of your capital, especially when using leverage. If you are a beginner, we strongly recommend starting on a demo account, using conservative risk (e.g., 0.25%–0.5% per trade), and only trading with money you can afford to lose.

Execute Like a Pro With United Kings (Clear Entries, SL/TP, Education)

If you’re serious about improving your forex signal execution, the fastest path is combining high-quality signals with a professional execution framework.

United Kings delivers premium Telegram signals for forex and gold with clear Entry, SL, and TP levels, built for active conditions in the London and New York sessions. We also share education alongside signals so you understand the “why,” not just the “what.”

- 85%+ win rate target with disciplined execution (no guarantees; results vary by trader and broker conditions).

- 300K+ active traders in the community learning and executing together.

- 48-hour money-back guarantee for peace of mind.

Choose the plan that fits your goals on our pricing page:

- Starter (3 Months): $299 (~$100/mo)

- Best Value (1 Year): $599 ($50/mo) with 50% savings + FREE ebook

- Unlimited (Lifetime): $999 pay once, access forever

Ready to execute your next trade with more discipline and less stress?

- Explore our premium forex signals and gold signals

- Or join the community directly on Telegram: United Kings official Telegram channel

Your edge isn’t just the signal. It’s how professionally you execute it—every single time.