You followed an XAUUSD signal perfectly… and still got slipped 18 points, stopped out, then watched gold run 60 points without you.

If that’s ever happened on Non-Farm Payroll (NFP) Friday, you’re not alone.

On NFP day, execution becomes the strategy.

Right now gold (XAUUSD) is trading around $2650 (+0.35% in 24h), DXY is near 106.80, EUR/USD around 1.0520, GBP/USD 1.2680, and USD/JPY near 149.50.

That combination often means tight liquidity pockets before the release and violent repricing after it.

This guide gives you a step-by-step XAUUSD NFP strategy focused on spreads, slippage, order type selection, and stop placement, so you can execute gold signals like a pro when the market is at its most chaotic.

TL;DR: XAUUSD NFP Strategy (Execution Rules That Matter)

- NFP day is not “normal trading.” Spreads can widen 3–10x, and slippage can invalidate tight stops.

- Default rule: avoid market orders at the release; use a post-spike confirmation entry or a carefully placed pending order.

- Stops must be volatility-adjusted. On NFP, $10 stops often behave like $3 stops—plan $15–$25 when trading the spike/retest.

- Reduce risk, not standards. Keep your strategy edge, but cut position size (often 30–70%) to survive slippage.

- Trade in two phases: (1) pre-news preparation and levels, (2) post-news execution and management.

- Best practice: trade only if you can accept a worst-case fill and still have a valid setup.

Why NFP Turns Gold Into a Different Instrument

Most traders approach NFP as “more volatility.”

That’s true, but incomplete.

NFP changes how gold trades at the microstructure level: liquidity thins, spreads widen, and brokers re-quote or slip fills.

So your usual XAUUSD setup—say a clean breakout with a $10 stop—can fail even if the direction is correct.

What makes XAUUSD uniquely sensitive on NFP?

Gold is priced in USD, so NFP hits it through the dollar channel first.

With DXY around 106.80, markets are already positioned with a USD bias.

That means the first move can be exaggerated as algos hunt stops and reprice yields.

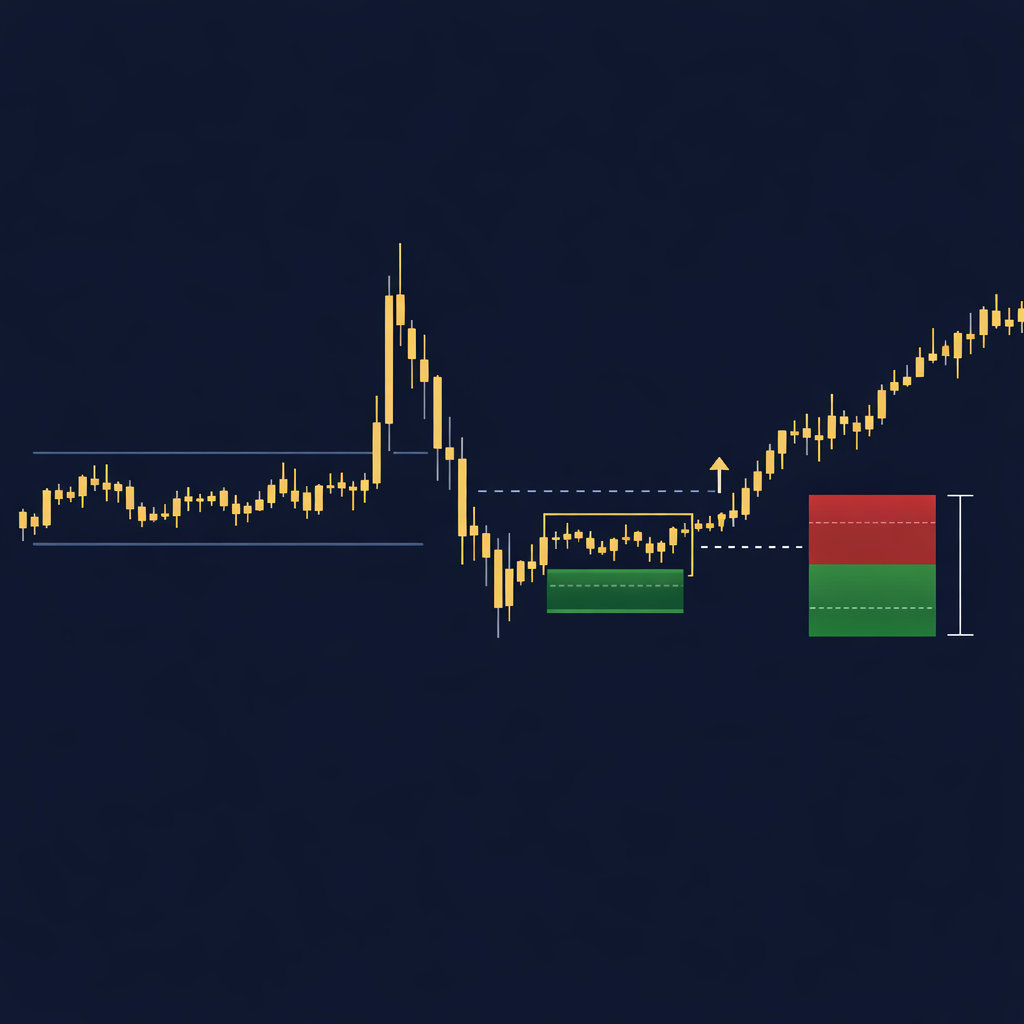

The “three-layer reaction” you must expect

On most NFP Fridays, XAUUSD reacts in three layers.

- Layer 1 (0–30 seconds): the headline spike. This is where spreads and slippage are worst.

- Layer 2 (30 seconds–5 minutes): the retrace/whipsaw. This is where most traders get stopped twice.

- Layer 3 (5–60 minutes): the real directional move after the market digests wages, revisions, and risk sentiment.

Our goal is not to “predict the spike.”

Our goal is to execute signals in a way that survives Layer 1 and Layer 2, so we can participate in Layer 3.

Why spreads and slippage matter more than direction

On a normal London/NY overlap, you might see XAUUSD spreads around 15–30 points (varies by broker and account type).

On NFP, it’s common to see spreads temporarily widen to 60–200 points.

If you enter at $2650.00 on a market buy, you might get filled at $2651.20 or $2652.00.

That’s not “bad luck.”

That’s the cost of demanding liquidity when everyone else is doing the same.

Pre-NFP Checklist: Build Your Trade Plan Before the Chaos

If you’re still deciding entry type when the number hits, you’re already late.

The best NFP execution is boring preparation.

Step 1: Know the exact event and what markets care about

NFP is not one number.

It’s a package: headline jobs, unemployment rate, and average hourly earnings (wages).

Gold often reacts most cleanly when wages confirm the inflation narrative.

Step 2: Map the “decision zone” on XAUUSD

With XAUUSD around $2650, you want two things on your chart:

- Asian range high/low (often the liquidity pool that gets swept first).

- London session high/low (often the real battleground for NY continuation).

Example mapping (realistic NFP morning conditions):

- Asian high: $2658

- Asian low: $2642

- London high: $2664

- London low: $2638

These levels become your “if/then” triggers.

Step 3: Decide your maximum acceptable spread and slippage

This is where professionals separate themselves.

Before NFP, define a rule like:

- Do not execute if spread is above 80 points (or your broker’s equivalent).

- Assume slippage of 10–25 points on stop orders during the first minute.

If you can’t accept those conditions, you should not trade the release.

Step 4: Reduce size and pre-calculate risk

NFP day is the day to trade smaller, not bigger.

Even experienced traders often cut size to 30–70% of normal because execution variance is higher.

If your usual risk is 1%, consider 0.3%–0.7% for NFP.

For a full framework, see our guide on risk management strategies when using forex signals.

Step 5: Confirm your broker’s execution mode

Two traders can take the same signal and get opposite outcomes due to broker conditions.

Check whether you’re on:

- Market execution (slippage possible both ways).

- Instant execution (re-quotes common).

- Stop level restrictions (minimum distance for pending orders).

This matters when you place buy stops/sell stops near price.

Order Types on NFP: Market vs Limit vs Stop (What Actually Works)

On normal days, “just enter at market” can be fine.

On NFP, market orders can be the most expensive way to participate.

Market orders: when they help and when they hurt

A market order is a demand for immediate liquidity.

During the first 10–30 seconds after NFP, immediate liquidity is scarce.

That’s why you see fills like buy at $2650.00 but executed at $2652.10.

Use market orders on NFP only if:

- You’re entering after the initial spike (Layer 3).

- Spread has normalized back near your acceptable range.

- Your stop is wide enough to survive a retest.

Limit orders: best for mean reversion, risky for momentum

Limits can reduce slippage because you set the worst acceptable price.

But limits can also cause missed trades if the market doesn’t retrace to your level.

On NFP, limits work best for the post-spike pullback.

Example: gold spikes from $2650 to $2668, then retraces.

A buy limit at $2658 with confirmation logic can be cleaner than chasing $2666.

Stop orders: the most misunderstood tool on news

Buy stops and sell stops are popular “straddle” tools.

But on NFP, stop orders are the most likely to get slipped because they trigger exactly when volatility peaks.

If you use them, you must plan for worst-case entry.

Comparison table: order types for XAUUSD NFP execution

| Order Type | Best Use on NFP | Main Advantage | Main Risk | When to Avoid |

|---|---|---|---|---|

| Market | Post-spike confirmation (5–30 min) | Guaranteed participation | High slippage at release | First 0–60 seconds |

| Limit | Pullback entries after spike | Controls entry price | Missed fills in fast continuation | When momentum is one-directional |

| Stop | Breakout with strict rules | Catches momentum instantly | Worst slippage + stop hunts | When spreads are unstable |

If you want a simplified rule: on NFP, we prefer confirmation entries over “guessing the first candle.”

That’s the core of consistent gold signals execution on news days.

The United Kings NFP Execution Framework (Two-Phase Model)

If you trade with signals, your edge is usually in the idea: direction + key level + invalidation.

On NFP, your edge must include execution rules that keep the idea intact.

Phase 1: Pre-news plan (levels + scenarios)

Before the release, define two scenarios: bullish gold and bearish gold.

Do not marry one bias.

Let price confirm.

Scenario A (bullish gold): DXY drops, yields soften, XAUUSD breaks above London high and holds.

Scenario B (bearish gold): DXY spikes, yields jump, XAUUSD breaks below London low and holds.

In both scenarios, your job is to identify:

- The level that must break (trigger).

- The level that must hold (invalidation).

- The area where you want to enter (ideal fill zone).

Phase 2: Post-news execution (spike → retrace → confirmation)

After the release, we wait for the market to show its hand.

We want to see a spike and then evidence that the spike is accepted or rejected.

Think of it like this:

- Spike: price grabs liquidity.

- Retrace: weak hands exit, spreads normalize.

- Confirmation: the real move begins.

Why this model reduces whipsaws

Most NFP losses come from entering in Layer 1 or Layer 2 with a normal stop.

Price whips 20–40 points, hits your stop, then trends 80 points.

By using a two-phase model, you give up the first 10–25 points of the move.

In exchange, you dramatically improve fill quality and reduce “random stop-outs.”

This is also how we structure many of our updates inside United Kings Gold Signals when high-impact events hit.

Step-by-Step: Executing a Gold Signal During NFP (Live Example)

Let’s walk through a realistic NFP execution plan using current market context.

Gold is around $2650 pre-release.

Volatility is elevated but not extreme.

Step 1: Identify the “no-trade window”

For most traders, the most dangerous time is 30 seconds before to 60 seconds after the release.

Spreads can widen instantly, and platforms can freeze.

Rule: no new market orders in that window.

Step 2: Mark your trigger levels

Example levels:

- Resistance/trigger: $2664 (London high)

- Support/invalidation: $2638 (London low)

- Midpoint magnet: $2650

Step 3: Decide your execution style (choose one)

Style A: Post-spike confirmation entry (recommended).

You wait for the spike, then enter after a pullback and a reclaim/hold.

Style B: Pending order with “worst fill” planning.

You place a stop order beyond the level, but you assume slippage and widen the stop.

Step 4: Apply a volatility-adjusted stop and target

Let’s say the signal idea is bullish: buy after confirmation above $2664.

On a normal day you might use a $8–$12 stop.

On NFP, we plan $15–$25 depending on spread behavior.

Example trade plan (confirmation style):

- Entry: Buy $2660 after spike to $2670 and pullback holds above $2658–$2660

- Stop loss: $2643 (risk $17)

- Take profit 1 (1:2): $2694 (reward $34)

- Take profit 2 (1:3): $2711 (reward $51) — only if volatility stays strong

Note: our guideline range for examples is $2610–$2690, so TP2 above $2690 is optional and only for extended moves.

If you want to keep it inside the range, you can structure TP2 at $2688–$2690 and trail the remainder.

Step 5: Execute only after spread normalizes

Even if price is perfect, execution can ruin it.

Rule: if spread is still abnormally wide, you wait.

Missing a trade is cheaper than entering a trade you can’t manage.

Step 6: Manage the position using “event rules”

On NFP, you manage based on structure, not feelings.

- If price moves +$12 to +$18 in your favor quickly, consider partial profit or reduce exposure.

- Move stop to breakeven only after a new structure high forms and holds.

- Expect at least one sharp pullback even in a trending move.

Spreads on NFP: How to Measure Them and Build Rules Around Them

Spreads are not just a cost.

On NFP, spreads are a signal of liquidity.

What spread widening really means

When your XAUUSD spread widens, it means market makers are protecting themselves.

They don’t know the next tick, so they charge more to take the other side.

Your job is to avoid trading when that protection cost is extreme.

Practical spread thresholds for XAUUSD on NFP

Every broker is different, but you can still use thresholds.

Here’s a practical framework:

- Normal conditions: trade as usual (your standard plan).

- Moderate widening: trade only with wider stops and smaller size.

- Extreme widening: no trades until it normalizes.

Example rule set (adjust to your broker):

- If spread is under 40 points: normal execution allowed.

- If spread is 40–80 points: confirmation-only entries, reduce size.

- If spread is above 80–120+ points: stand down.

How spreads interact with stop placement

This is the part most traders miss.

Your stop is executed on the opposite side of the quote.

If spread widens, your stop can be hit even if the chart “never touched it.”

That’s why tight stops fail on NFP.

How to adapt when you’re following signals

If you’re using a signal with Entry/SL/TP, treat NFP as a special condition day.

You have three responsible options:

- Skip the trade if your broker’s spread makes the setup invalid.

- Reduce size and keep the same levels if spread is acceptable.

- Use confirmation entry and adjust the stop based on volatility (only if you understand the invalidation logic).

If you want help selecting a provider whose signals include clear invalidation logic, read our forex signals provider checklist.

Slippage on NFP: The Hidden Risk That Breaks “Perfect” Setups

Slippage is the difference between the price you request and the price you get.

On NFP, it’s normal.

What’s not normal is ignoring it in your math.

Where slippage hurts most

- Stop orders that trigger into the spike (buy stops / sell stops).

- Stop-loss orders during a liquidity vacuum.

- Market orders placed in the first minute after release.

How to “price in” slippage before you trade

Professional execution means you assume a worst-case fill.

Example: you plan to buy $2660 with a $17 stop at $2643.

If you expect 12 points of slippage, your effective entry might be $2661.20.

Your effective risk becomes $18.20, not $17.

That changes your position size and your R:R.

A simple slippage-adjusted position sizing method

Instead of sizing off the “ideal” stop distance, size off:

- Stop distance + expected slippage + spread buffer

If your stop is $17, expected slippage is $1.2 (12 points), and spread buffer is $0.6 (6 points), you size as if risk is $18.8.

This keeps your account risk stable even when execution is messy.

Positive slippage exists—but don’t rely on it

Sometimes you get filled better than expected.

That’s a bonus, not a plan.

Build your NFP execution around survivability, not best-case fills.

How United Kings traders handle this in practice

Inside our premium signals, we focus on clean invalidation points.

On NFP, many traders choose confirmation entries and smaller size so a bit of slippage doesn’t destroy the setup.

That’s how you keep your decision-making consistent under stress.

Stop Placement on NFP: Where Most Traders Lose (And How to Fix It)

On NFP, the market doesn’t “respect” your stop.

It searches for liquidity.

And the easiest liquidity is clustered stops near obvious levels.

The biggest mistake: using a normal-day stop in a news-day market

If your usual stop is $8–$12, NFP can hit it just by breathing.

When gold is whipping $15–$30 in seconds, your stop must reflect that environment.

Two stop models that work on NFP

Model 1: Structure-based stop (preferred).

You place the stop beyond a level that, if broken, invalidates the idea.

Example: if you buy after reclaiming $2658–$2660, your invalidation might be below $2642 (Asian low) or $2638 (London low).

Model 2: Volatility-based stop (ATR-style).

You size the stop based on recent range expansion.

On NFP, that often means $15–$25 stops for XAUUSD in the $2610–$2690 zone.

Concrete stop examples in today’s price range

Bullish continuation example:

- Entry: $2659.50 (after pullback holds)

- Stop: $2644.50 (risk $15)

- TP: $2689.50 (reward $30, 1:2)

Bearish continuation example:

- Entry: $2641.00 (after breakdown and retest)

- Stop: $2658.00 (risk $17)

- TP: $2607.00 (reward $34, 1:2) — if you want to stay within $2610–$2690, set TP at $2610–$2612 and trail

The “stop widening trap” and how to avoid it

Wider stops are not automatically safer.

If you widen the stop but keep the same lot size, you increase risk.

So the rule is:

If stop gets wider, size gets smaller.

This is why NFP is a risk management test more than a prediction contest.

Post-Spike Confirmation Tactics: How to Avoid the NFP Whipsaw

If you only take one idea from this article, take this:

Let the first spike happen without you.

Then trade what remains after spreads normalize and structure forms.

Tactic 1: “Break → reclaim → hold” (B/R/H)

This is one of the cleanest ways to trade gold during news.

Example:

- NFP spikes gold down from $2650 to $2639 (liquidity sweep below London low).

- Price immediately reclaims $2644 and then $2650.

- You wait for a hold above $2650 and enter on the first pullback.

In this case, the spike down was a trap.

You didn’t need to predict it—just recognize the reclaim.

Tactic 2: “Two-candle confirmation” on the 1–5 minute chart

On NFP, single candles lie.

Two closes above/below a key level are harder to fake.

Rule example:

- Only buy if two 1-minute candles close above $2664 and the second candle does not have a long upper wick.

- Only sell if two 1-minute candles close below $2638 and the second candle holds below.

Tactic 3: “Retest entry” instead of breakout entry

Breakouts on NFP are expensive.

Retests are calmer and often cheaper.

Example:

- Gold breaks above $2664 to $2672.

- It retraces to $2663–$2665.

- You buy the retest with a stop under $2648–$2650 depending on structure.

Tactic 4: Use time as confirmation

Time filters are underrated.

Example rule:

- Don’t enter until 3–5 minutes after the release.

- Don’t move stop to breakeven until one full 5-minute candle closes in your favor and structure holds.

If you want more on adapting signals to sudden volatility, read how gold signals react to unexpected news events.

Managing Open Trades on NFP: TP Logic, Partial Profits, and Trailing

NFP trades can go from +$8 to -$12 in seconds.

So trade management must be rule-based.

Take-profit planning: keep it realistic

With gold around $2650, a typical NFP directional move can be $20–$60.

That’s why 1:2 and 1:3 risk-reward targets are realistic if your stop is $15–$25.

Example:

- Entry: $2656

- Stop: $2641 (risk $15)

- TP1: $2686 (1:2)

- TP2: $2690 (psychological level / range cap) with a trail for extension

Partial profits: why they help on NFP

On NFP, partial profits reduce emotional pressure.

They also reduce the damage if the market snaps back.

A common model:

- Close 30–50% at TP1 (1:1.5 to 1:2).

- Hold the rest for TP2 or trail behind structure.

Trailing stops: use structure, not a fixed number

Fixed trailing stops get hunted on NFP.

Instead, trail behind:

- the last 5-minute swing low (for buys), or

- the last 5-minute swing high (for sells).

When to exit early (the “conditions changed” rule)

Sometimes the best trade is the one you close early.

Exit early if:

- Spread widens again unexpectedly.

- Price fails to hold the reclaimed level and closes back inside the range.

- You see a second violent reversal that breaks your setup’s logic.

For traders juggling multiple positions, this pairs well with disciplined routines like the ones discussed in our broader educational resources on the United Kings blog.

Signal Execution Rules: How to Follow XAUUSD Signals Without Getting Trapped

Signals are powerful when your execution matches the market regime.

NFP is a different regime.

Rule 1: Treat the signal as a thesis, not a button

A high-quality signal includes Entry, SL, and TP.

On NFP, you also need an execution layer:

- What order type will you use?

- What spread is acceptable?

- Will you wait for confirmation?

Rule 2: If spread breaks the setup, you skip

This is not “fear.”

This is professionalism.

If your stop is $15 and spread is $2.00 equivalent at the moment, your trade is structurally compromised.

Rule 3: Use the “entry zone” concept on NFP

Instead of one exact entry price, define an entry zone.

Example:

- Signal says buy at $2658.

- Your acceptable zone might be $2657.50–$2660.50.

- If you get filled at $2662.00, you pass.

Rule 4: Don’t move the stop closer to feel safe

On NFP, tighter stops feel safe but behave unsafe.

Let the trade breathe or don’t take it.

Rule 5: Keep your session focus

We focus heavily on London and New York sessions because that’s where liquidity and follow-through are most consistent.

NFP is a New York event.

So your best opportunities often come after the dust settles and NY chooses direction.

If you’re new to executing signals in Telegram communities, our guide on how to use forex signals on Telegram will help you build a clean routine.

Common NFP Mistakes on XAUUSD (And the Fix for Each)

NFP punishes the same behaviors every month.

Fixing them is often worth more than finding a new indicator.

Mistake 1: Trading the first candle because “it’s moving”

The first candle is where spreads and slippage peak.

Fix: wait for a spike + pullback + confirmation.

Mistake 2: Using the same lot size as a normal day

Execution variance increases.

Fix: reduce size and keep your account risk constant.

Mistake 3: Placing stops at obvious round numbers

Stops at $2650.00 or $2640.00 are magnets.

Fix: use structure-based stops beyond the level that invalidates your idea.

Mistake 4: Moving stops to breakeven too early

NFP pullbacks are sharp.

Fix: move to breakeven only after structure confirms (not after a single green candle).

Mistake 5: Overtrading after one loss

NFP can trigger revenge trading fast.

Fix: set a max number of attempts (often 1–2 trades) and walk away.

If you want a deeper look at avoiding execution traps, our community often discusses these patterns alongside daily updates in the United Kings Telegram channel.

Putting It All Together: Your NFP Day XAUUSD Signal Execution Plan

Here’s a clean, repeatable plan you can copy into your notes.

It’s designed for traders who want to trade gold during news without gambling on the first tick.

1) 60–30 minutes before NFP

- Check current price (around $2650) and mark Asian + London highs/lows.

- Define bullish and bearish scenarios.

- Set your max spread rule and expected slippage assumption.

- Reduce risk (0.3%–0.7% typical) and pre-calc size.

2) 10 minutes before NFP

- Cancel unnecessary pending orders.

- Make sure platform is stable and you’re not on weak internet.

- Decide: confirmation entry only, or pending order with strict rules.

3) Release moment (no-trade window)

- No new market orders from 30 seconds before to 60 seconds after (rule-of-thumb).

- Observe spike direction and which level gets swept.

4) 2–10 minutes after release

- Wait for spreads to normalize.

- Look for reclaim/hold or breakdown/retest.

- Enter using your chosen confirmation tactic.

5) Management

- Take partials at 1:1.5–1:2 if volatility is wild.

- Trail behind 5-minute structure.

- Stop trading after 1–2 attempts if conditions are messy.

Where United Kings fits into this plan

Our signal format is built for execution: clear Entry, SL, and TP levels.

And our community is active around London and NY sessions, which is when NFP follow-through tends to appear.

Explore our dedicated gold signals and broader forex signals coverage if you trade multiple markets.

FAQ: Trading XAUUSD on NFP Day

Is it better to trade XAUUSD before or after NFP?

For most traders, after is better.

Pre-NFP can be choppy and post-release can be chaotic, but the cleanest opportunities often come 5–30 minutes after when spreads normalize and structure forms.

What stop-loss size is reasonable for gold on NFP?

It depends on volatility and your setup, but many NFP trades require $15–$25 stops to avoid random noise.

If you can’t reduce size enough to keep risk controlled, skip the trade.

Should I use pending orders (buy stop/sell stop) on NFP?

Only if you understand slippage and plan for worst-case fills.

Stop orders can trigger into the worst liquidity conditions, so many traders prefer post-spike confirmation entries instead.

Why did my stop get hit when price didn’t touch it on the chart?

Because stops execute on the bid/ask side, and spread widening can hit your stop even if the mid-price chart doesn’t show it clearly.

This is common on NFP.

Do United Kings signals work on NFP days?

Signals can still be valid, but execution rules matter more on NFP.

We focus on clear levels and invalidation logic, and many traders use confirmation entries and reduced risk to handle spreads and slippage.

Risk Disclaimer (Read Before You Trade NFP)

Trading forex and gold (XAUUSD) involves significant risk and may not be suitable for all investors.

NFP days can include extreme volatility, widened spreads, slippage, and rapid losses.

Past performance is not indicative of future results. No signal or strategy can guarantee profits.

If you’re a beginner, consider practicing on a demo account before trading live, and never risk money you can’t afford to lose.

Join United Kings: Execute Gold Signals With a Real Plan

If you want to trade NFP with structure instead of stress, you need two things: clear levels and execution discipline.

United Kings delivers premium Telegram signals for forex and gold with a community of 300K+ active traders, focused heavily on London and NY sessions.

We aim for high-quality setups with clear Entry, SL, and TP levels, supported by educational guidance so you understand how to execute—not just what to buy or sell.

Choose the plan that fits your goals on our pricing page:

- Starter (3 Months): $299 (~$100/mo)

- Best Value (1 Year): $599 ($50/mo) with 50% savings + FREE ebook

- Unlimited (Lifetime): $999 pay once, access forever

Start here: United Kings premium trading signals or go straight to our XAUUSD gold signals.

For real-time updates and community discussion, join our Telegram: United Kings signals on Telegram.

If you have questions before joining, visit about United Kings or message us via contact support.