Gold Trading Signals are alerts that suggest when to buy or sell gold. During unstable markets, investors use these signals to make informed decisions. This guide explains how to use Gold Investment Signals effectively. You will learn the basic process for acting on a signal. We will also talk about important ways to handle danger. Our goal is to give you a clear, step-by-step plan. This method gives you comfort as you deal with market volatility. By the end, you will understand how to integrate these signals into a safer trading plan for uncertain times.

Why Gold Shines When Everything Else Fades

Gold has been a trusted safe-haven for centuries. Why? Its value isn't tied to any government or company. When stocks fall, fear rises. Investors rush to assets they perceive as safe. This "flight to safety" pushes gold's price up. It's a classic diversification move. Think of gold as insurance for your portfolio. The goal isn't to get rich quick. The goal is to preserve your capital. Then, to grow it steadily when opportunities arise. Gold Trading Signals are the alert system for these opportunities. They tell you when the smart money is starting to move.

Your Game Plan: How to Act on a Gold Signal

A signal is just noise without a plan. Here is a breakdown of how to use a Gold Investment Signals alert from a quality provider.

- The Alert: You receive a message: "BUY XAUUSD. Entry: $2350. Stop Loss: $2335. Take Profit: $2375."

- The Rationale: The signal comes with a reason. For example, "Breaking key resistance level on high volume amid Fed uncertainty." This context is crucial.

- Execution: You enter the trade exactly as instructed. Discipline is everything. You do not second-guess the levels.

- Risk Management: Your stop loss is your lifeline. It defines your risk before you even enter the trade. Never trade without one.

This structured process removes emotion. You are following a system, not a fear or a greed.

The Mistake New Gold Traders Make (And How to Avoid It)

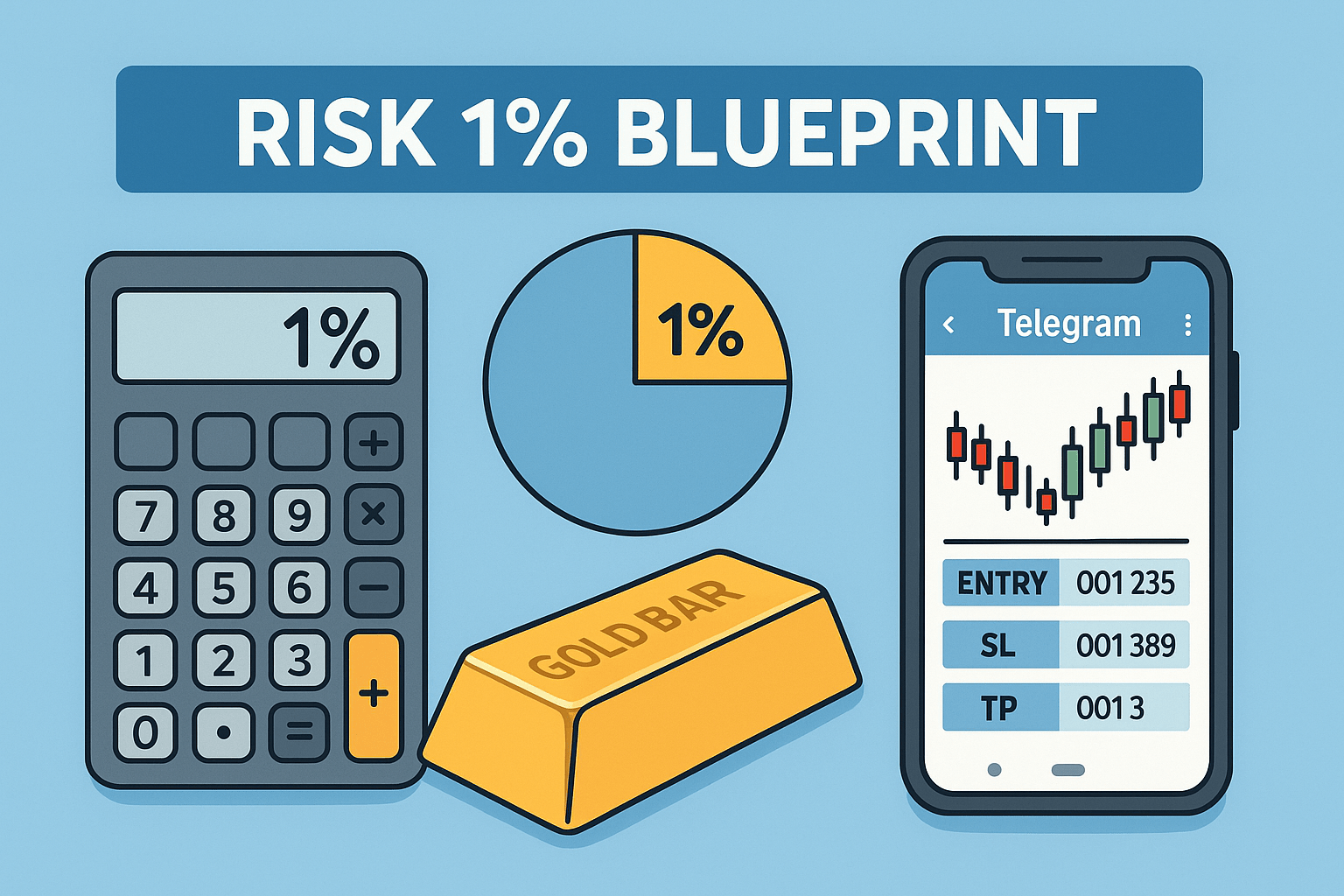

The biggest error is over-leveraging. Gold can be volatile. A small price move can cause big losses if your position is too large. Even the most accurate Gold Trading Signals cannot prevent this self-inflicted error. The solution is simple. You should never put more than 1% to 2% of your money on one trade. This way, even if you lose a transaction, it's not a disaster; it's just a setback. It lets you stay in the game long enough for the plan to work out for you. Patience and position sizing are your secret weapons.

Your Path to Becoming a Disciplined Gold Trader

Turbulent markets don't have to be terrifying. They can be opportunities. By leveraging professional Gold Investment Signals, you can navigate the storm with a clear map. You move from being a passive observer to an active, disciplined trader. The key is choosing a provider that values transparency and education above hype. Look for verified results and clear risk management. Are you ready to trade not just with hope, but with a proven plan?

At United Kings, we provide the clarity and precision you need to turn market fear into a strategic advantage.

FAQs

1. What is the success rate of Gold Trading Signals?

Success rates vary by provider. Look for services with independently verified track records. A high win-rate is good, but solid risk-to-reward ratios on each trade are more important for long-term profitability.

2. How much capital do I need to start using these signals?

You can start with a modest amount. The key is proper position sizing. With a good broker, you can begin trading micro-lots, risking a very small percentage of your account on each signal you receive.

3. Are gold signals suitable for beginner investors?

Yes, if the provider offers clear guidance. Signals can help beginners learn market dynamics by following professional trade setups and their rationales. Always start in a demo account to practice first.

4. What is the biggest risk in following gold signals?

The biggest risk is not the signal itself, but poor trade execution. This includes over-leveraging, ignoring stop-loss orders, or emotionally deviating from the provided plan. Discipline is your greatest protection.