Swing trading and day trading are two of the maximum popular approaches for trading in the forex market. There are pros and cons to each approach, and the selection between them in general comes down to personal taste, danger tolerance, and how much time you need to spend. In this blog, we're going to examine the differences between swing trading and day trading, focusing on how each technique makes use of foreign exchange alerts to make buying and selling choices.

Understanding Swing Trading and Day Trading

Swing trading means maintaining positions for days or even weeks in order to make money when the market goes up or down. Traders who use this technique look at technical analysis, chart patterns, and indicators to find possible moments where they can enter and exit a trade. The idea is to catch price changes over a medium-term time frame. Day trading, on the other hand, means initiating and closing positions on the same day.

The Role of Forex Signals in Trading Strategies

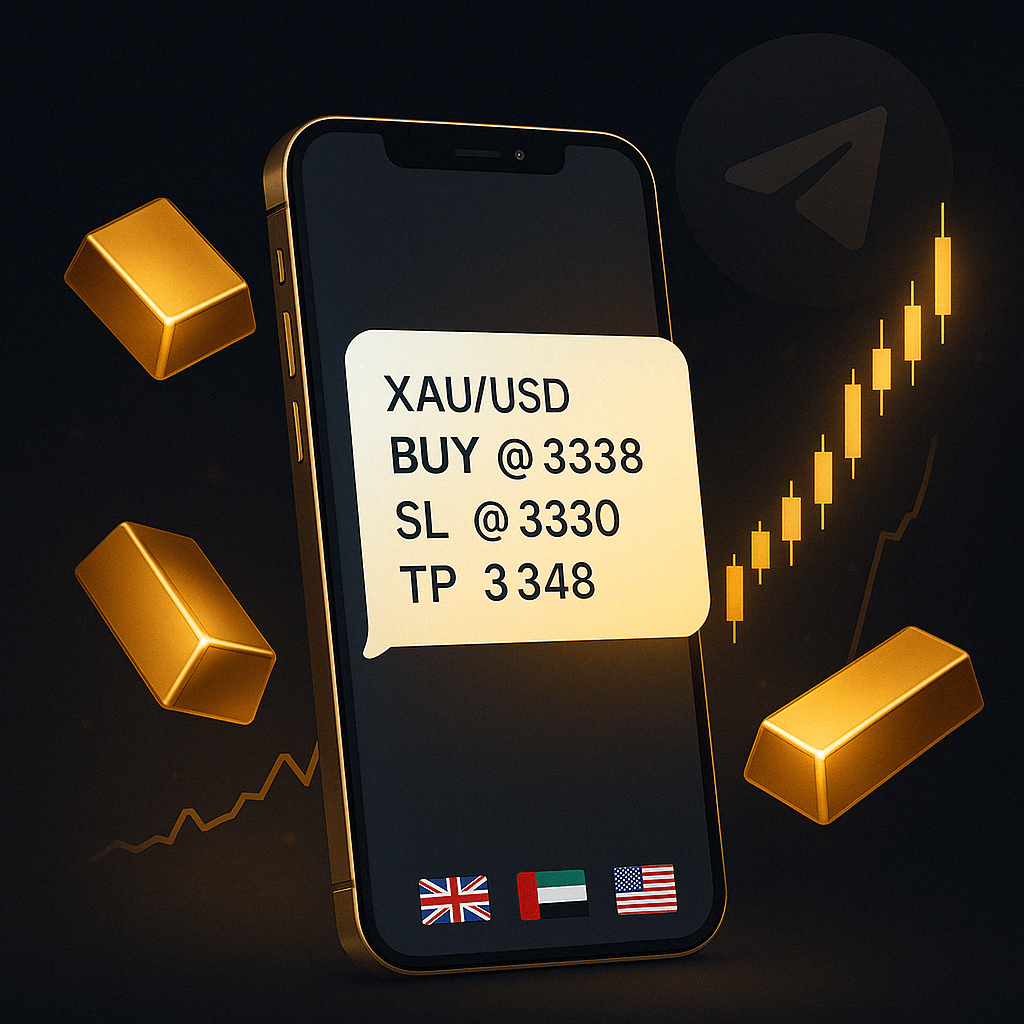

Swing Trade Forex Signals and day traders make decisions about their trades. A Forex Trading Signals Service sends you real-time alerts and advice based on technical analysis, market trends, and expert opinions. These signals usually tell you things like where to enter, where to set a stop-loss, and where to take profits. Forex alerts assist swing traders in discovering feasible change opportunities that align with their medium-term view. These symptoms allow you to discover the exceptional times to go into a trade and set the proper stop-loss levels to keep your risk under control.

Time Commitment

Swing trading usually takes less time each day than day trading. Swing traders look at the markets every so often, spending a few hours each day going over charts and looking for possible trades. This means that swing trading is better for people who can't spend all day trading. Day trading, on the other hand, requires you to pay close attention to the markets all the time. Traders need to keep an eye on price modifications all day and make brief judgments on whether or not to buy and sell. This degree of involvement can take loads of time and won't be possible for all and sundry.

Risk and Reward

Swing traders usually hold positions overnight or for several days, which puts them at risk overnight. But the chance of bigger price changes over a longer period of time can lead to big earnings. Day trading lets you close positions the same day, which is a good thing, but it usually means you make less money per deal. Frequent trading might add up transaction expenses, which could hurt overall profitability.

Skill Set and Experience

To be a successful swing trader, you need to know a lot about technical analysis and be able to read chart patterns and indicators. Traders also need to be patient while they wait for the correct setups to show up. People that day trade need to be able to make decisions quickly and respond quickly to changes in the market. Also, you need to know a lot about how the market works and be able to handle stress well.

Leveraging Forex Signals for Effective Trading

Using the Forex Trading Signals Service lets you make higher buying and selling choices, no matter what method you pick. These services provide traders with useful statistics and recommendations that enable them to find feasible opportunities and deal with risks well. Forex signals can help swing investors find transactions that fit with their medium-term imaginative and prescient. These indicators assist you in determining the best times to enter and exit an exchange, as well as the right stop-loss levels.

Conclusion

There are both pros and cons to swing trading and day trading. It depends on your own preferences, how much risk you're willing to take, and how much time you have to spend on each strategy. Using a Forex Trading Signals Service can help you make smart choices, no matter how you like to trade. To choose the best technique, it's important to think about your own situation and United Kings ambitions. Keep in mind that to be a good trader, you need to keep learning and changing. Using reliable forex signal providers and keeping up with market movements can greatly improve your trading results.